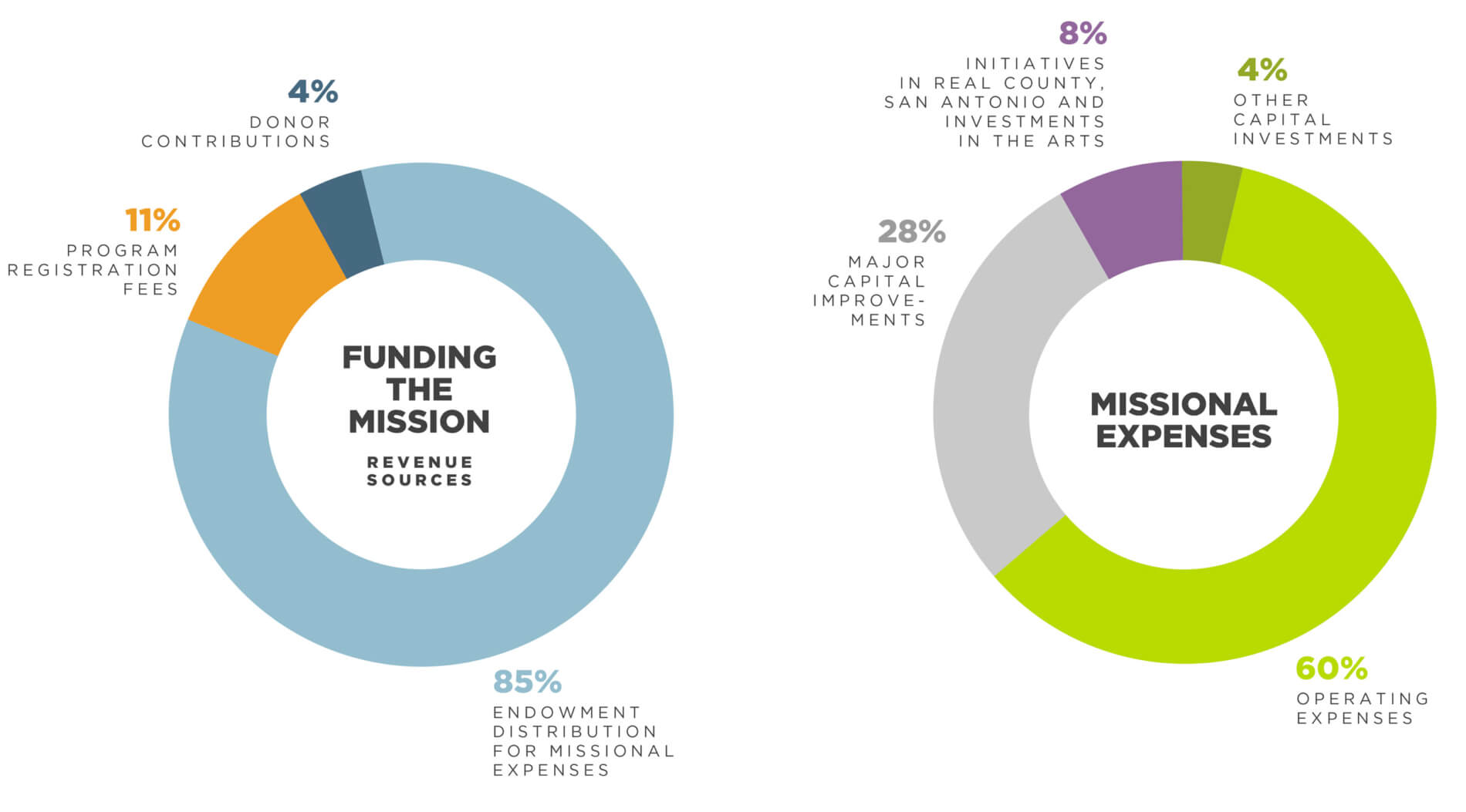

As the Foundation continues to align its programs with its Mission, we are continually analyzing how best to invest resources to deliver the most impact to our programs, strategic partners, and guests. Since adopting a new financial model in 2016—one that now relies on our existing endowment as the primary source of revenue for operating expenses—the Foundation has worked rigorously to prepare the organization for success in the future.

In 2017, our Investment Committee, in collaboration with institutional investment consultants, worked to design and implement a new investment strategy that will better meet the financial needs of a foundation operating within an endowment model and bolstered by capital campaigns and ongoing gifts from donors.

The committee executed its new investment plan, achieved over 95 percent of its targeted asset allocation goals, and led the Foundation through a disciplined process of benchmarking its administrative, overhead, fundraising, and staffing expenses to provide clarity and guidance during annual budget reviews. The team also provided key oversight on capital projects as Laity Lodge completed renovations of its 55-year-old facilities and as the Foundation began revisiting the need for adequate office space for Foundation staff in Kerrville and San Antonio.

We celebrated the retirement of Tom Witt, a longtime trusted advisor to the Foundation’s Investment Committee, and the addition of two new advisors on the Investment Committee, Mark Warner and Randy Cain. The addition of Mark and Randy will increase the Committee’s collective experience in portfolio oversight and investment management. We are pleased with the talent that is engaging to help steward the Foundation.

In 2018 the committee will continue to build out the Foundation’s investment portfolio and provide our Board of Directors with enhanced quarterly reporting on investment performance versus benchmarks and peers, general investment status, and compliance with investment policy.

Mark Warner currently serves as Director of Investments (Natural Resources and Private Equity) for the $41 billion UTIMCO fund. Mark and his wife, Cissy, have been active with HEBFF for many years as LLYC campers—Cissy was a camp counselor as well—and as advisors on the Foundation’s Resource Development Council.

Randy Cain, Regional Managing Director for Ernst & Young and previous investment committee chairman for the $1.6 billion Texas A&M 12th Man Foundation, has agreed to join the Committee. Randy has been a long-term supporter and friend of the Foundation and of the Butt and Rogers families.

David Rogers, Dwight Lacy, and committee chairman Mike Mulcahy will continue to serve on the committee.